CONVENTIONAL

30 Yr 4.50 to 4.875 APR 5.376

15 Yr 4.00 to 4.25 APR 4.64

JUMBO & ARMS

5 Yr Please Call

7 Yr Please Call

FHA/VA/USDA

30 Yr 4.25 APR 5.375

15 Yr 4.00 APR 5.1

Mortgage related market intelligence.

CONVENTIONAL

30 Yr 4.50 to 4.875 APR 5.376

15 Yr 4.00 to 4.25 APR 4.64

JUMBO & ARMS

5 Yr Please Call

7 Yr Please Call

FHA/VA/USDA

30 Yr 4.25 APR 5.375

15 Yr 4.00 APR 5.1

December’s private payroll saw its biggest monthly increase in nearly 2 years, suggesting sustained strength in the labor market despite ongoing financial market volatility.

Weak performance and volatility in stocks have driven investors to the safety of bonds. As yields fall, mortgage rates are likely to drop along with them.

A dip in consumer confidence shows households may be worried about the economy. If the economy slows, mortgage rates could benefit further.

CONVENTIONAL

30 Yr 4.625 to 4.875 APR 5.12

15 Yr 4.125 to 4.625 APR 4.89

JUMBO & ARMS

5 Yr Call Me On Rate

7 Yr Call Me On Rate

FHA/VA/USDA

30 Yr 4.375 APR 5.54

15 Yr 4 APR 5.126

CONVENTIONAL

30 Yr 4.75 to 5 APR 5.38

15 Yr 4.25 to 4.625 APR 4.89

JUMBO & ARMS

5 Yr Call Me On Rate

7 Yr Call Me On Rate

FHA/VA/USDA

30 Yr 4.5 APR 5.635

15 Yr 4.125 APR 5.387

Many would-be homebuyers assume that spring and summer are the best times to buy a new house. After all, the kids are out of school, the weather’s nice and it seems like that’s when all the inventory hits the market. Why not use the nice weather and extra time to your advantage?

In reality, though, winter can be a favorable time to buy. From fewer bidding wars to a faster, easier closing, here’s what buying a house in winter can offer:

These are just a few of the benefits of buying in this winter.

CONVENTIONAL

30 Yr 4.875 to 5.125 APR 5.573

15 Yr 4.5 to 4.75 APR 5.125

JUMBO & ARMS

5 Yr Call Me On Rate

7 Yr Call Me On Rate

FHA/VA/USDA

30 Yr 4.75 APR 5.897

15 Yr 4.25 APR 5.53

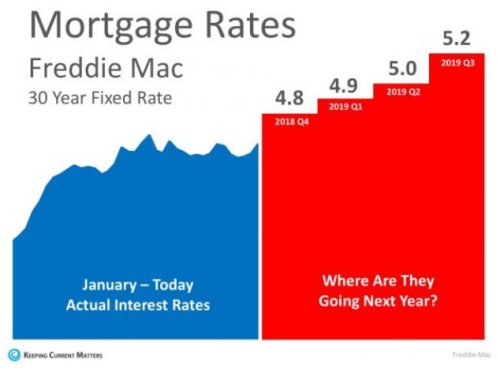

Below is a chart created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily over the course of the next year.

To be more responsive to your inquiries, starting August 1, 2018, we add LiveChat feature to our website.

Our service department, brokers and property managers will be online answering your questions. Feel free to try it if you need any help.

LiveChat is powered by LiveChat.