CONVENTIONAL

30 Yr 4 to 4.25 APR 4.28

15 Yr 3.25 to 3.5 APR 3.59

ARMS

5 Yr 3.375 to 4 APR 4.1

7 Yr 3.875 to 4.375 APR 4.41

FHA/VA

30 Yr 3.5 APR 3.56

15 Yr 3 APR 3.12

Mortgage related market intelligence.

CONVENTIONAL

30 Yr 4 to 4.25 APR 4.28

15 Yr 3.25 to 3.5 APR 3.59

ARMS

5 Yr 3.375 to 4 APR 4.1

7 Yr 3.875 to 4.375 APR 4.41

FHA/VA

30 Yr 3.5 APR 3.56

15 Yr 3 APR 3.12

Consumer confidence surged to a 16+-year high in March. Consumer optimism is supported by a strong labor market and a positive economic outlook.

The GDP increased 2.1% in the 4th quarter, signaling economic growth. Consumer spending accounts for more than 2/3rds of U.S. economic activity.

Some Fed members made comments this week supporting more than 3 rate hikes this year. The majority still favor a gradual approach to increases though.

Although the Fed raised policy rates at this week’s meeting, mortgage rates improved when the Fed forecasted gradual future increases, calming markets.

The Fed’s policy rate change will help tame inflation, which has been on the rise. Inflation can be a factor in increasing future mortgage rates.

The economy is expected to continue to grow, as supported by recent data. The labor market is strong and consumer confidence is improving.

A Fed policy rate hike next week is now almost 100% certain, after recent comments by Fed officials. The Fed anticipates three rate increases in 2017.

The Fed’s mandate is to keep strong employment and low inflation. Jobs data this week showed the labor market remains strong, with low unemployment.

Inflation is on the rise, both in the U.S. and abroad, as the economy continues to grow. Inflation pressures mortgage rates and could contribute to higher rates.

Gallup reports its Economic Confidence Index hit a new high in January, reaching its highest monthly average in 9 years.

The labor market continues to show strength, with jobless claims hitting a 43-year low this week and a strong showing for non-farm payrolls last week.

Despite the strong economy, inflation is still lagging. As long as inflation remains low, there’s less pressure for rates to rise.

CONVENTIONAL

30 Yr 4.125 to 4.125 APR 4.25

15 Yr 3.250 to 3.500 APR 3.61

ARMS

5 Yr 3.250 to 3.625 APR 3.87

7 Yr 3.625 to 4.375 APR 4.41

FHA/VA

30 Yr 3.625 APR 3.73

15 Yr 3.250 APR 3.32

As expected, the Fed raised policy rates 0.25% at this month’s FOMC meeting. Bond yields jumped on the news, pressuring mortgage rates higher.

The U.S. dollar is at the highest level since 2003, and stocks continue to hit all-time highs. Strong economic activity contributes to mortgage rates increasing.

The Fed is expected to continue to raise policy rates in 2017, possibly up to three times. Rising inflation and a tightening job market support this speculation.

Mortgage rates rose as markets prepare for expected economic growth and anticipated inflation under the Trump administration. Inflation can bring higher rates.

Fed Chair Janet Yellen’s comments this week support the idea of a Fed policy rate hike in December. Economists almost unanimously agree a hike is coming.

Also supporting a possible Fed policy rate hike, the labor market continues to show strength, and consumer prices recorded their biggest increase in 6 months.

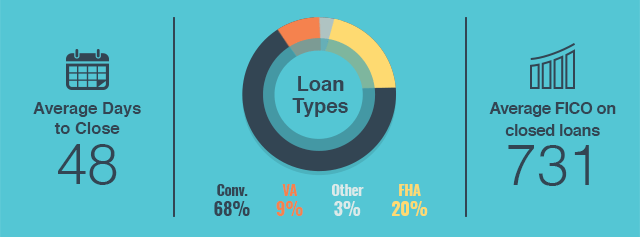

With the anticipating of rate increase, the number of re-fi jumped up 2% month-over-month. Average FICO score is now 731 which is the all time high. Although the days to fund/close is 48 days, most new purchase loan got closed in 30 days while re-fi took longer, about 60 days, so the average is 48 days. In order to get away mortgage insurance, the average Loan-to-Value (LTV) is 78% and this is very encouraging. It means most borrowers have either sizable down payment or have equity built up over years before they re-fi. All these are good indicators that mortgage market is a lot healthier these days.

|

|

|

|

Markets worldwide reacted to Trump’s victory, causing mortgage rates to rise. The reaction was to his proposed economic policies, not his political agenda.

Initially markets were expected to react negatively to Trump’s win. Instead stocks rallied and bond yields skyrocketed on early belief that inflation will follow.

The Fed is now overwhelmingly expected to raise policy rates at their December meeting. However, the Fed’s decisions have not failed to surprise in the past.