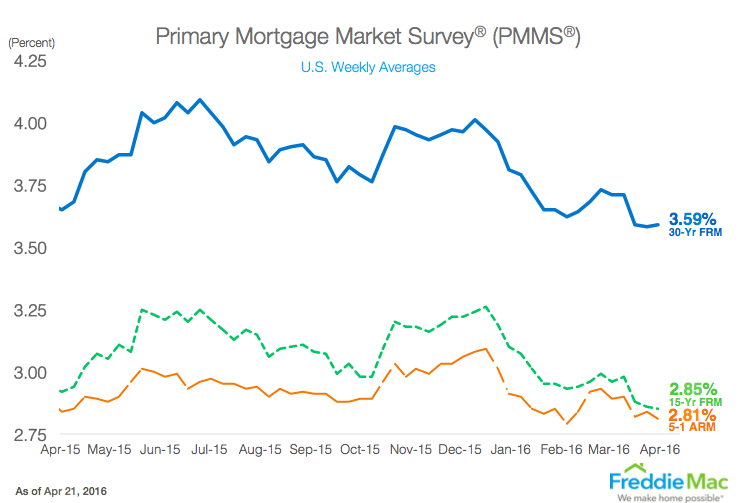

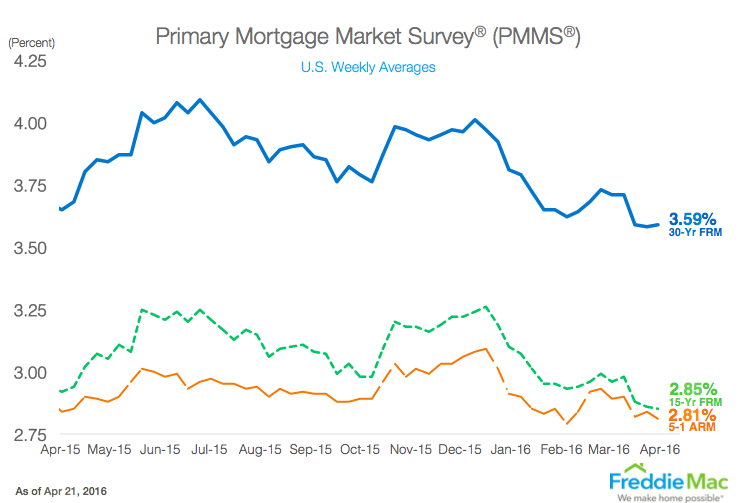

Mortgage rates barely nudged in Freddie Mac’s latest Primary Mortgage Market Survey, with mortgage rates remaining near the lowest level of the year and the lowest level in nearly three years, as the chart below shows.

The 30-year fixed-rate mortgage averaged 3.59% for the week ending April 21, up from last week’s when they averaged 3.58%. A year ago at this time, the 30-year FRM averaged 3.65%.

In addition, the 15-year FRM this week came in at 2.85%, down from last week when it averaged 2.86%. In 2015, the 15-year FRM averaged 2.92%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.81% this week, falling from 2.84% a week prior. A year ago, the 5-year ARM averaged 2.84%.

“Volatility in financial markets subsided over the past week, allowing Treasury yields to stabilize. As a result, the 30-year mortgage rate was mostly flat, up only 1 basis point to 3.59%,” said Sean Becketti, chief economist, Freddie Mac.

“The release of March’s existing-home sales report, which shows monthly growth at 5.1%, suggests homebuyers are taking advantage of low mortgage rates as the spring homebuying season gets underway,” Becketti added.